What is the right investment strategy right now?

Problems are piling up worldwide: geopolitical crises, inflation, recession - where is my money safe?

There is no universal investment strategy that suits every investor!

An investment strategy is always individual and does not depend on the economic environment, but primarily on the individual financial situation, coupled with the investor's risk tolerance.

For this reason, an investment and risk profile is always drawn up at the beginning of a client relationship. In a discussion with the future investor, the "risk tolerance" is determined. This is then used to develop the investment strategy, which enables the percentage allocation of the investments according to categories: as a rule, these are: cash, bonds, shares, alternative investments and real estate.

Example: One of the most common investment strategies is known as "balanced": It has roughly the following breakdown of asset classes:

Cash: 5%, Bonds: 40%, Equities: 45%, Alternative investments: 5%, Real estate: 5%.

This strategy is popular because it combines riskier and growth-oriented investments such as equities with more conservative and less risky investments such as bonds. This meets the need of many investors to balance risks.

When is the best moment to invest?

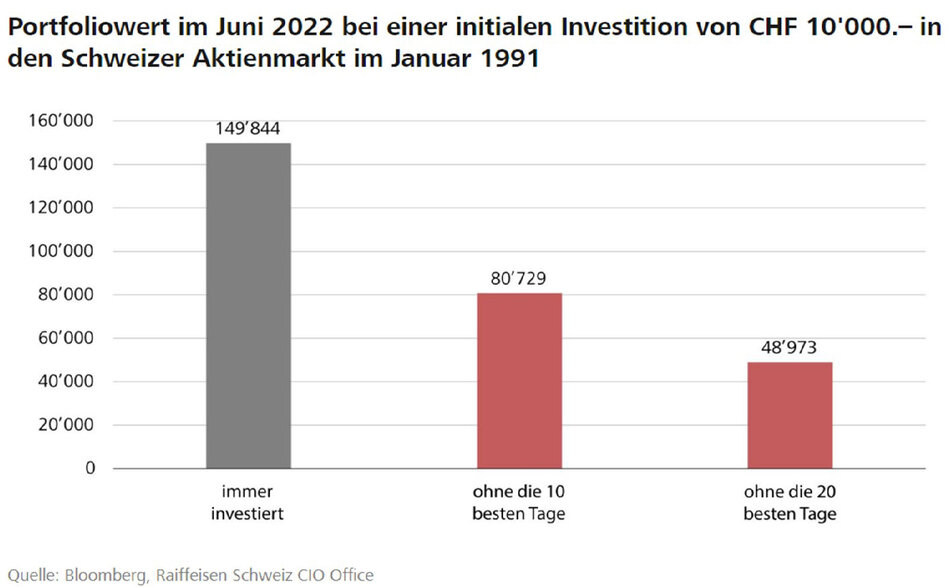

Of course, there are more ideal and less favourable moments to enter the financial markets. In many cases, however, the ideal time for courageous investors with a longer-term investment horizon is during or shortly after a crisis. Apart from that, it is impossible to define the right time to invest in the short term. In the long run, however, it is clear that "not being invested" leads to significantly worse results than "being invested". The chart below shows how a portfolio performs when one is always invested compared to the situation where one misses the best 10 or the best 20 days. Since the best days cannot be predicted, "being invested" is better than the other way around.

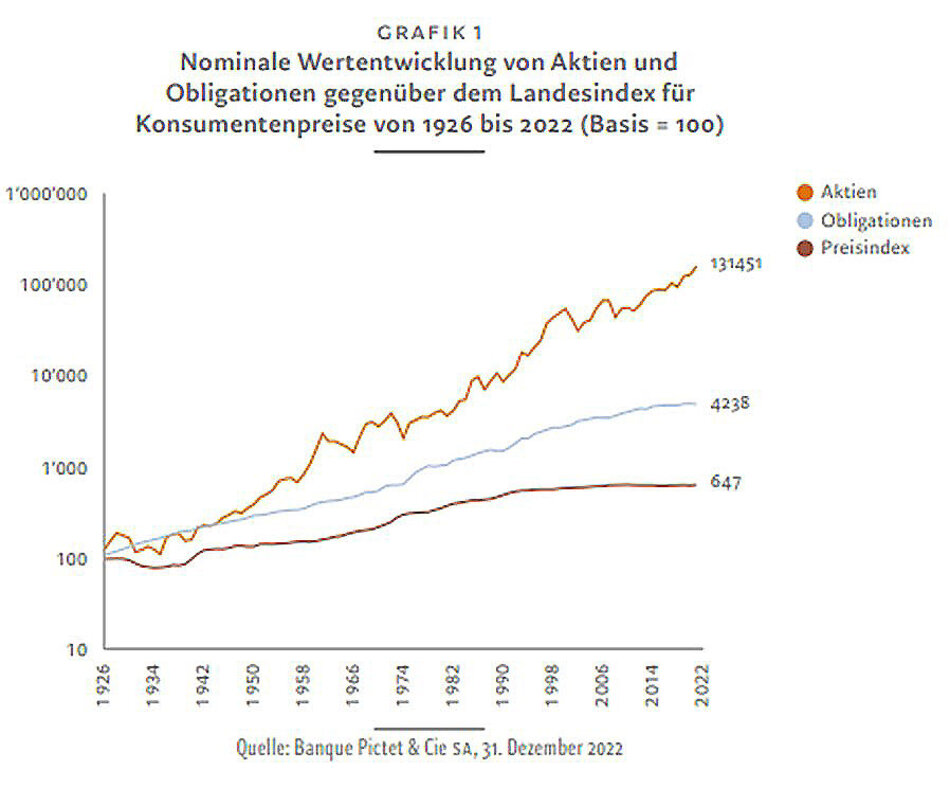

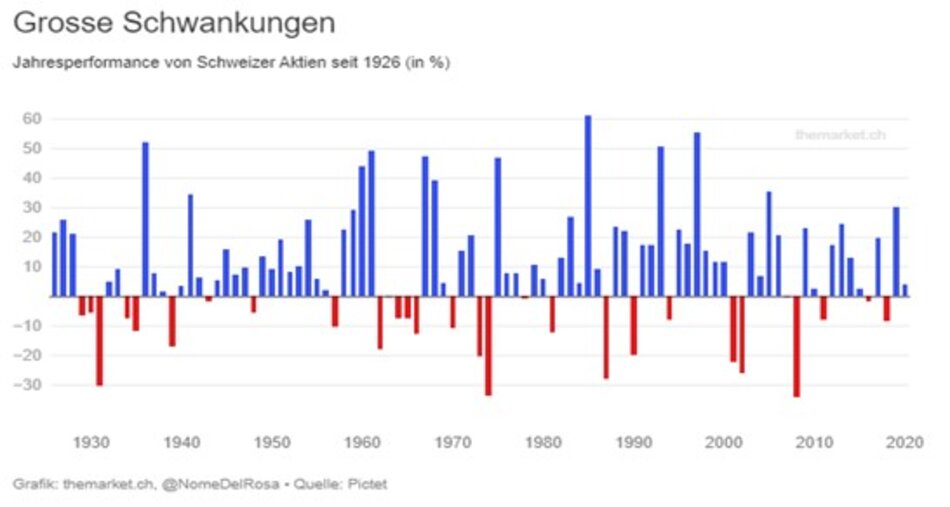

In the longer term, shares, including dividend payments (compound interest effect), and real estate remain the best investment opportunities. An investment horizon of at least 10 years is important.

In the long term, there is no way around shares!

However, investing in shares over the long term also means that an investor must be able to withstand major price fluctuations and crises.

What are the investment styles for equity investors?

Buy and Hold

Buy and Hold means that you buy securities and hold them for a longer period of time regardless of market fluctuations. In doing so, you expect a "steady" rise in the global financial markets over a longer period of time. Among others, the well-known investor Warren Buffett (Berkshire Hathaway) also trusts in this long-term strategy.

Growth-Strategie

Growth investors pay attention to the growth potential of a company. On the one hand, this can bring above-average profits, but it also entails greater risks. Companies with above-average growth dynamics are particularly attractive. These cyclical stocks are more susceptible to economic dips and rising interest rates.

Value-Strategie

The value strategy selects shares that are trading below their supposed value (e.g. price-to-book ratio). Value investors therefore focus on companies that hold their value. This means companies that have large assets, a good market position, high returns and stable profit development. Patient value investors are usually rewarded in the longer term, provided they have done the valuation analysis correctly.

Dividendenstrategie

In the dividend strategy, investors focus on securities with a high dividend yield. These companies pay an above-average dividend (> 4%) for years and are also called dividend aristocrats. If the dividend is regularly reinvested, the compound interest effect takes effect.

What to do in the current environment?

The global capital markets are currently going through complicated scenarios characterised by considerable inflation or stagflation risks. This creates unclear paths for the real economy and contradictions in the financial markets. Significantly higher interest rates also reduce the relative attractiveness of equity investments compared to fixed-interest investments.

The geopolitical situation also continues to create uncertainty.

Current investment strategy

For this reason, we currently recommend a neutral weighting of equity investments in relation to your strategy. Fixed-income investments (bonds) can be made again after a long phase of negative interest rates made this practically impossible for a long time.

As inflation may prove more persistent than expected, we are also considering the purchase of a broad-based, equally weighted commodity investment in "Alternative Investments".

The inflationary environment favours commodity price trends.

As mentioned earlier, times of economic uncertainty also always offer favourable buying opportunities. Of course, various factors/key figures must be analysed very carefully. For equity investments, the valuation as well as the debt should not be too high. In the case of fixed-interest investments, attention should be paid to the maturity and the debtor's quality (rating).

In summary, the following applies to investors with a long-term horizon: Today's environment characterised by rising interest rates, inflation and geopolitical risks could, in retrospect, prove to be an ideal time to enter the market, as many equities have corrected strongly (and some are no longer expensively valued). In a future cycle of economic boom, prices and valuations should then also be significantly higher again.

The conclusion for investors: invest steadily over a longer time horizon, reinvest interest and dividends and review the portfolio regularly!

Focus on costs

When choosing your asset manager, be sure to consider the costs as well! Particularly with a long-term investment horizon, the level of annual fees can be an important factor, especially as it can be influenced independently of movements in the market.

We advise individuals and legal entities on all legal matters around wealth management and are a pioneer in impact investing, which is part of our entrepreneurial identity.

Our focus is on

✓ effort based charging

✓ impact investments

✓ avoiding conflicts of interests

✓ comprehensive overview of your total assets