Short-term or long-term mortgage? - an update

SARON mortgages (money market mortgages): The SARON (Swiss Average Rate Overnight) is a representative reference rate of the Swiss money market and correlates closely with the key interest rate of the Swiss National Bank. The SARON mortgage follows changes in the money market. When interest rates rise, you pay more, and when they fall, you pay less. On top of this interest rate, banks and financial institutions add a margin, which is on average about 80 basis points (0.80%). Thus, the current interest rate is about 1.80%. With SARON, a switch to a fixed-rate mortgage is possible at any time.

Fixed mortgages: Fixed mortgages have a fixed interest rate and a fixed term, usually between two and ten years. Some banks and financial institutions also allow longer-term fixed-rate mortgages. This allows you to secure favorable interest rates for years to come, know your interest burden and protect yourself against rising market interest rates. However, with this product you will not benefit from any interest rate reductions.

Below you will find the indicative interest rates for fixed mortgages (top conditions according to Moneypark as of 06.01.2023). Due to loan-to-value, affordability, mortgage volume and property location, these may vary significantly:

| Fixed 2 years from | 1.90% |

| Fixed 5 years from | 2.20% |

| Fixed 7 years from | 2.30% |

| Fixed 10 years from | 2.35% |

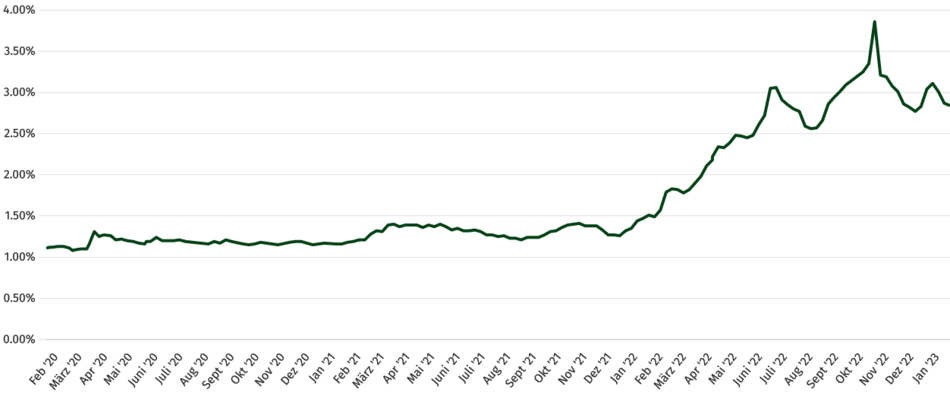

The chart below shows the development of the ten-year fixed-rate mortgage over the last three years:

Source: moneypark.ch/zinsen/zinsentwicklung 24.01.2023

To determine which mortgage models are most suitable for you, it is important to ask yourself the following questions:

- How do I handle interest rate fluctuations (risk tolerance)?

- How big is my budget (financial leeway)?

- How actively do I follow the development of interest rates (interest in the market)?

If you assume that short-term interest rates will continue to rise and want to rule out negative surprises, a two-year fixed-rate mortgage is an alternative to the SARON mortgage. This way, you protect yourself during this period from further increases in interest costs and from exceeding your financial leeway. At maturity, the situation can then be reassessed and adjusted.

If you need planning security, we still recommend splitting the mortgage into a short-term and a long-term mortgage.

We advise individuals and legal entities on all legal matters around wealth management and are a pioneer in impact investing, which is part of our entrepreneurial identity.

Our focus is on

✓ effort based charging

✓ impact investments

✓ avoiding conflicts of interests

✓ comprehensive overview of your total assets