Indirect amortization

With direct amortization, the debt, i.e. the second mortgage, is repaid in regular installments. As a result, the debt amount decreases regularly and the interest to be paid on the debt also decreases. The part to be amortized is covered by a variable mortgage with possibly fluctuating interest rates, since repayments are not possible during the term of a fixed mortgage.

For some, this is a good solution, as it reassures them that the debt is continuously decreasing. However, this also causes the interest on the debt to steadily decrease, the amount that can be deducted from taxable income becomes less, and the tax burden increases each year.

The alternative is indirect amortization: Here, the portion to be amortized is paid into a pillar 3a account or custody account. The annual payments to the third pillar are pledged to the creditor bank, but not repaid directly as a debt. The debt remains the same until repayment (usually at the time of retirement), the interest on the debt also, and at the moment of repayment, the second mortgage is repaid with the Pillar 3a payout.

This has tax advantages:

Both the mortgage interest and the contributions to pillar 3a can be deducted from taxable income, so you benefit twice for tax purposes.

The Pillar 3a capital and the income from the pension capital are tax-free and the capital is taxed at a favorable special rate when it is withdrawn. The mortgage debt, on the other hand, is deducted from taxable assets, which means that potential wealth taxes also remain low or are eliminated during this period.

If you want to amortize larger amounts, this is possible indirectly through a purchase into the pension fund, if there is purchase potential there. This purchase sum is then withdrawn as capital at the time of retirement and used for repayment.

Indirect amortization is only possible for owner-occupied residential property. The annual deposits are subject to the respective maximum deposit for pillar 3a. Since the beginning of this year, this has been CHF 7,056 for employees with a pension fund connection and CHF 35,280 for self-employed persons without a pension fund (maximum 20% of net income).

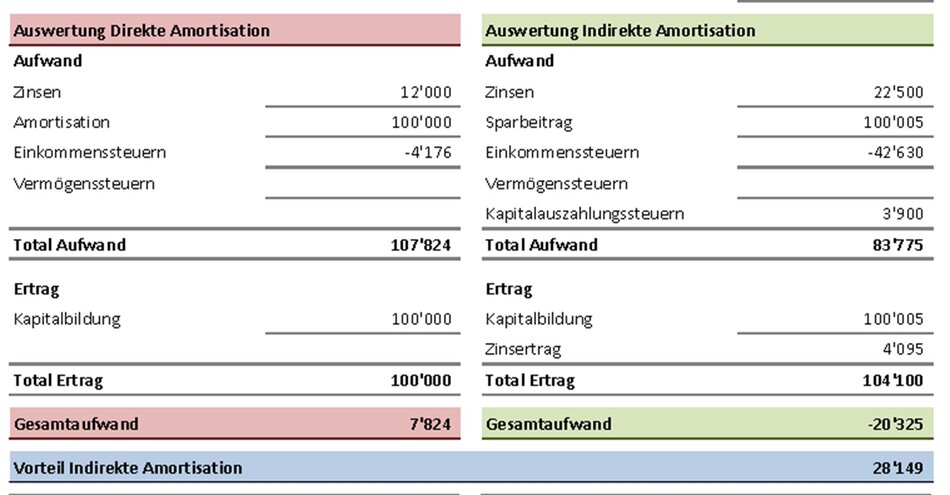

Below is a comparison of direct to indirect amortization with the following assumptions:

Mortgage to be amortized CHF 100'000, taxable income CHF 135'000, married, marginal tax rate 34.8%, interest on mortgage 1.5%, interest on 3rd pillar 0.5%, repayment in 15 years.

The total advantage of CHF 28,149 of indirect amortization over direct amortization takes into account the higher debt interest and capital payment taxes.

The tax savings of CHF 42,630 for the indirect amortization is composed of:

- Tax savings through debt interest CHF 7,830

- Tax savings through contributions pillar 3a of CHF 34'800

This is offset by a tax saving from debt interest in the case of direct amortization of CHF 4,176.

Sollten Sie Fragen zum Thema haben, so wenden Sie sich gerne an

Stephanie Cuche

Lic.rer.pol, Finanzplanerin mit eidg. FA

Bildquelle: www.unsplash.com mit Montage

We advise individuals and legal entities on all legal matters around wealth management and are a pioneer in impact investing, which is part of our entrepreneurial identity.

Our focus is on

✓ effort based charging

✓ impact investments

✓ avoiding conflicts of interests

✓ comprehensive overview of your total assets