Microfinance performs positively even in crisis year 2022

The investment year 2022 is challenging. In addition to the strong correction of shares, the significant losses of bonds are a burden on defensively oriented investors. Bonds are interest-bearing securities traded on the stock exchange whose price falls when interest rates rise because newly issued securities pay higher interest than those already in circulation. Traditionally, bonds are considered less susceptible to fluctuations than shares. However, so far in 2022, they have recorded losses, in some cases well into double digits.

However, there is one bond-like investment segment that has delivered positive performance so far in 2022: Loans to micro and small enterprises in emerging markets, known as microfinance or impact bonds. This segment is a prime example of impact investing, as it is not only about financial returns but also about the positive development impact of the investment. Microcredits create jobs in poor countries and promote local entrepreneurship. This is a very effective way to fight poverty. The segment has developed strongly in the last 20 years and increasingly larger loans are granted to SMEs, which play an important role in job creation.

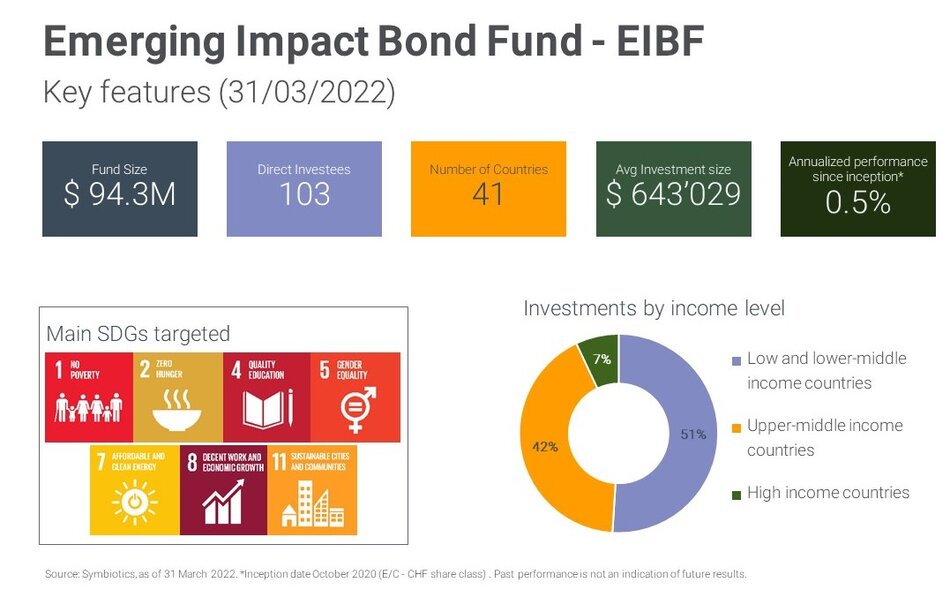

Invethos is involved in this investment area through the Emerging Impact Bond Fund (EIBF). The EIBF has gained between 0.1% and 1.5% so far in 2022, depending on the tranche. There are various reasons for the positive performance:

- Interest rates are generally higher in emerging markets, which yields attractive returns even after currency hedging costs.

- The loans that the fund grants to microfinance institutions in emerging countries have short maturities. Rising interest rates are therefore quickly reflected in new loans granted, which has a stabilising effect. Moreover, since most loans are not traded on the stock exchange, fluctuations are lower.

- The EIBF's investments are diversified across many countries. Our partner and fund manager Symbiotics is present on the ground and operates a comparatively rigorous risk management.

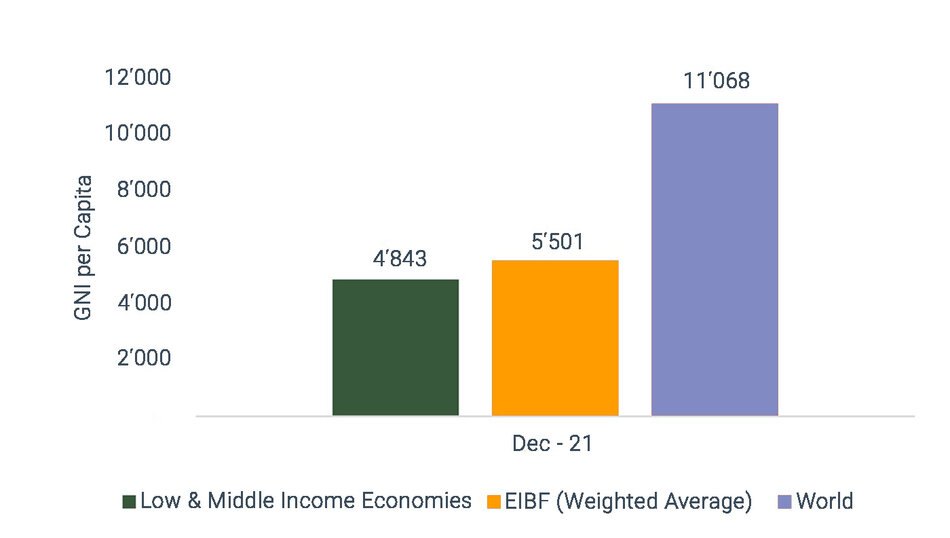

Microfinance is sometimes criticised because the approach is not immune to abuse and because sometimes there are players in the market who do not exercise the necessary care or client protection when granting loans. Accordingly, as an investor it is important to evaluate microfinance institutions that pass on the loans to the end clients well and to measure the impact of the investment where possible. In the case of the Emerging Impact Bond Fund, the impact is reviewed in an annual impact report. The chart above shows that the fund invests primarily in low- and middle-income countries. Calculated per capita, the average income in 2021 in the investment countries was USD 5,501 per year. The following chart shows this in relation to the world average. By way of comparison, per capita income in Switzerland averaged USD 76,000 in 2021. The EIBF therefore invests "in the right place".

We advise individuals and legal entities on all legal matters around wealth management and are a pioneer in impact investing, which is part of our entrepreneurial identity.

Our focus is on

✓ effort based charging

✓ impact investments

✓ avoiding conflicts of interests

✓ comprehensive overview of your total assets