Digital assets are digital representations of values that are not issued or guaranteed by any central bank and do not have the legal status of currency or money. Digital assets exist on a blockchain in the form of cryptocurrencies, crypto securities or security tokens and are stored in so-called wallets.

Since their creation, Bitcoin and other cryptocurrencies have been the subject of debate among supporters and critics about their properties and value.

The economic benefit of a cryptocurrency in everyday life can be described as insignificant. Traditional currencies are essentially backed by the national economy (economic performance) of the respective country, which is reflected in the exchange rate. In contrast, Bitcoin and most cryptocurrencies have nothing on the other side of the balance sheet, at least no valuable asset, but only the speculative demand of other potential buyers and the limited supply. We therefore do not expect cryptocurrencies to replace today's fiat currencies. The decentralised structure of cryptocurrencies lacks the control mechanism to react to economic cycles. Countries and central banks will not want to relinquish this control mechanism and may react with bans. Limited cryptocurrencies face the same challenges as gold currencies. They have a deflationary effect in a growing economy and increase unemployment.

Therefore, just like gold, cryptocurrencies are not money, as originally intended, but an "alternative asset class".

Nevertheless, it is important to note an important difference: Gold primarily serves to reduce the risks in the portfolio, while cryptocurrencies significantly increase the risks and opportunities and therefore the volatility. Gold has a decisive advantage over Bitcoin in the event of a crisis: it is a material, tangible asset! It is also indestructible and cannot be produced artificially.

As the mining of cryptocurrencies becomes more complex, the energy required to extract a coin increases. In the last five years, the electricity required for mining has increased tenfold. According to estimates by auditing firm PwC, it is currently over 129 terawatt hours per year - almost a third more than Switzerland's total consumption. According to the United Nations, around two thirds of the electricity used to mine bitcoins comes from fossil fuels. Bitcoin proponents argue that mining is often carried out during power surplus windows, thus contributing to network stability, and that alternative energy producers can break even more quickly if Bitcoin mining can be added.

Other risks include the security of cryptocurrency wallets and the use of cryptocurrencies for illegal or criminal activities. According to the EU law enforcement agency Europol, the illegal use of cryptocurrencies is primarily associated with money laundering, online trade in illegal goods and services and fraud. The extent of the illegal use of cryptocurrencies is estimated to be less than 1%. The suitability of digital assets for criminal activities is primarily due to the lack of regulation of decentralised structures. As they become more widespread, it can be assumed that regulation will increase and misuse will decrease.

Digital assets (BTC) in the investment portfolio:

Diversification or digital rollercoaster ride?

In recent years, cryptocurrencies have developed from a digital experiment into a global investment theme. In 2024, the authorisation of crypto ETFs in the USA opened a door that made it easier for investors to access this investment. The election of Donald Trump as US president has given this asset class even more oxygen. The prospect of a further relaxation of regulations and the possible introduction of a Bitcoin "currency reserve" in the US are boosting investor confidence.

With the new Stablecoin Act ("Genius Act"), the US wants to restructure the financing of its debt situation. Stablecoins are digital assets linked to an asset such as the USD. One of the US's goals in connection with stablecoins is to increase demand for US debt and thus lower interest rates. Stablecoins are thus being used in the service of an already unsustainable debt economy.

Investors who decide to buy bitcoins should be aware of the correlation between bitcoins and various asset classes. This investment is likely to increase the risk of the portfolio and the journey will then tend towards a digital rollercoaster ride.

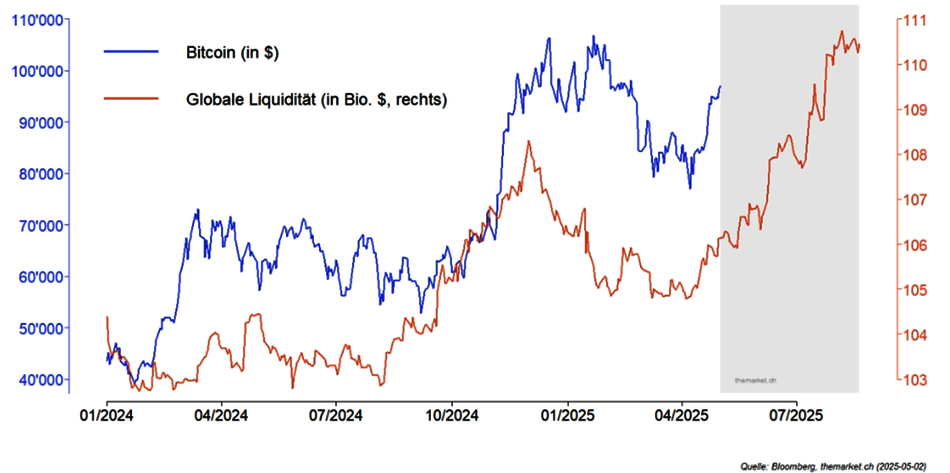

Global money supply M2: Bitcoin has a high correlation to the global money supply M2. A rising money supply can lead to inflation, which increases the demand for assets with limited availability such as Bitcoin (chart).

Interest rates: Falling interest rates have a positive impact on Bitcoin, as this provides the market with more liquidity and vice versa. There is therefore also a high correlation here.

Equity market: The correlation with global equity markets is limited, but increases in the event of strong market movements.

Nasdaq 100 (technology stocks): The correlation to US technology stocks is noticeably high, especially during market optimism or pessimism.

Gold: A negative correlation can occur particularly during economic uncertainty or high market volatility: Investors flee into gold while bitcoin loses value.

Reasons why cryptocurrencies can be part of the asset allocation in a portfolio:

Cryptocurrencies can be part of an asset allocation for several reasons:

Diversification: cryptocurrencies offer a way to diversify a portfolio. For the most part, they do not correlate directly with traditional asset classes such as equities or bonds (exception: US technology stocks).

Potential for additional returns: Historically, some cryptocurrencies, particularly Bitcoin and Ethereum, have experienced significant increases in value. Investors who are willing to take on increased risk could benefit from these potential returns.

Inflation protection: In contrast to fiat money, cryptocurrencies such as Bitcoin are limited in quantity (21 million). This can act as a hedge against inflation. The relentless debt policy of many governments supports this trend.

Growing interest and acceptance: The acceptance of cryptocurrencies is increasing, both among institutional investors and small investors. As a result, there have recently been growing signs of increasing structural stability (less massive and less pronounced price fluctuations), which could lead to increased demand and thus increases in value in the future.

Flexibility: Cryptocurrencies can now be easily traded via financial products (ETFs) and also in account form. This gives investors the opportunity to react quickly to market changes (= easier tradability).

Strategic reserves of central banks: Various countries are considering setting up a strategic reserve in Bitcoin: USA, Japan, Middle East, emerging markets. This would provide additional support for the price of Bitcoin.

Challenges and risks:

Volatility: cryptocurrencies are very volatile and can experience large price movements in a very short period of time. This can increase the risk of a portfolio and is an important aspect that must be taken into account in asset allocation.

Regulatory uncertainty: The legal framework for cryptocurrencies is not yet standardised worldwide, which can lead to uncertainty. changes in regulation could influence the value and use of cryptocurrencies.

Lack of historical data: Cryptocurrencies have only existed for less than 20 years, which makes it difficult to use long-term historical data for sound analysis.

High energy consumption: The high energy demand of crypto assets and AI applications could lead to energy shortages, which could result in corresponding government regulations.

It is important to consider the risks associated with investing in cryptocurrencies. Depending on the investor's risk profile, a certain proportion of crypto may be justifiable in a dynamic portfolio.

A simulation (chart smzh) illustrates that even a small addition of Bitcoin or Ether can significantly influence the dynamics of a 60/40 portfolio.

A look at the change in Sharpe ratios shows that the risk-adjusted return improves significantly in all three simulations (5% BTC, 5% ETH, 2.5% BTC/2.5% ETH). A higher Sharpe ratio means that the return improves in relation to the risk taken. This allows portfolios to be optimised even more effectively along the efficiency curve. However, a similar increase in the Sharpe ratio can also be achieved by adding gold, for which there are more reliable and long-term data series.

Invethos AG does not use digital assets as a portfolio component in the Invethos asset management mandates. This is mainly for the following reasons:

- The portfolio diversification effects can also be achieved with gold. There are longer data series for gold and sustainable mining and trading is possible.

- We have no reliable valuation basis for cryptocurrencies. The intrinsic value is zero and it is also not an energy store.

- Cryptocurrencies have very high volatility.

- There is regulatory uncertainty associated with cryptocurrencies. We expect increasing regulation and thus also capture by states and central banks.

- Energy consumption is too high. The contribution to network stability and the promotion of renewable energies would have to be more widely demonstrated and implemented.

- The lack of regulation makes cryptocurrencies more susceptible to use in criminal circles. This point could still change and is not actually a characteristic of cryptocurrencies. The drug mafia is still predominantly paid in USD.

At the client's request, investments can be made in consultation with our client advisors, e.g. via 21Shares ETPs or other financial products.

We do not make forecasts for cryptocurrencies in general or Bitcoin in particular. Technical analyses (charts) can be used to identify certain trends. After soaring above USD 100,000 at the turn of 2024/25, the price of Bitcoin regained its footing after dipping below USD 80,000 and subsequently reached new highs of around USD 112,000.

In the longer term, there are no limits to the price of BTC and certain other cryptocurrencies, both upwards and downwards.

Despite this assessment, Invethos AG will continue to focus on the development of digital assets or cryptocurrencies. We believe that curiosity is a good quality and we see many weaknesses in the current financial and monetary system. The inflationary debt economy demands more and more money. This money is created by national banks, but rarely reaches those who need it, but rather the banks first (the so-called "Cantillon effect"). Credit money is also subject to a relentless pressure to grow, which keeps the spiral described above going. Even if we do not believe that cryptocurrencies will replace fiat money, we do believe that major reforms will take place. In such situations, it is advantageous to navigate the world with a broad field of vision.