Individual investments in the occupational pension scheme

Occupational pension provision (2nd pillar), together with the 1st pillar, guarantees basic protection in old age, in the event of disability or death. Within occupational pension provision, so-called 1e plans are becoming increasingly important. The term 1e plan refers to Article 1e of the Ordinance on Occupational Pension Plans (BVV 2), which regulates these plans. They offer employees considerably more flexibility in their pension planning and allow for a customised investment strategy. Experience has shown that senior executives are more risk-averse and could achieve higher returns with an appropriate investment strategy. This makes a supplementary pension as part of a 1e pension plan worth considering for many companies.

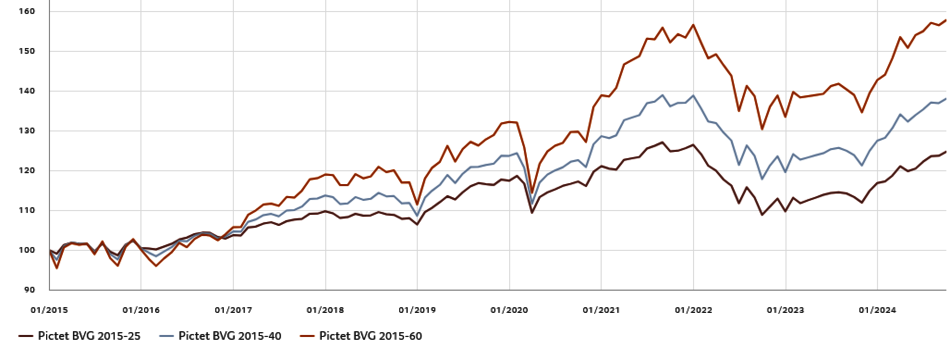

A higher proportion of equities results in higher potential returns. The following chart shows the BVG indices of Bank Pictet for equity shares of 25%, 40% and 60%. All of these returns are significantly higher than the average interest rate of autonomous collective foundations. Such investment strategies can be modelled as part of a 1e solution. The equity component can be increased to a maximum of 85%.

In cooperation with PensExpert AG and Bank Julius Baer (as custodian bank), Invethos AG offers flexible and customised 1e solutions in the extra-mandatory area of occupational pension provision. Two different pension plans are offered: PensFlex and PensUnit.

PensFlex collective foundation

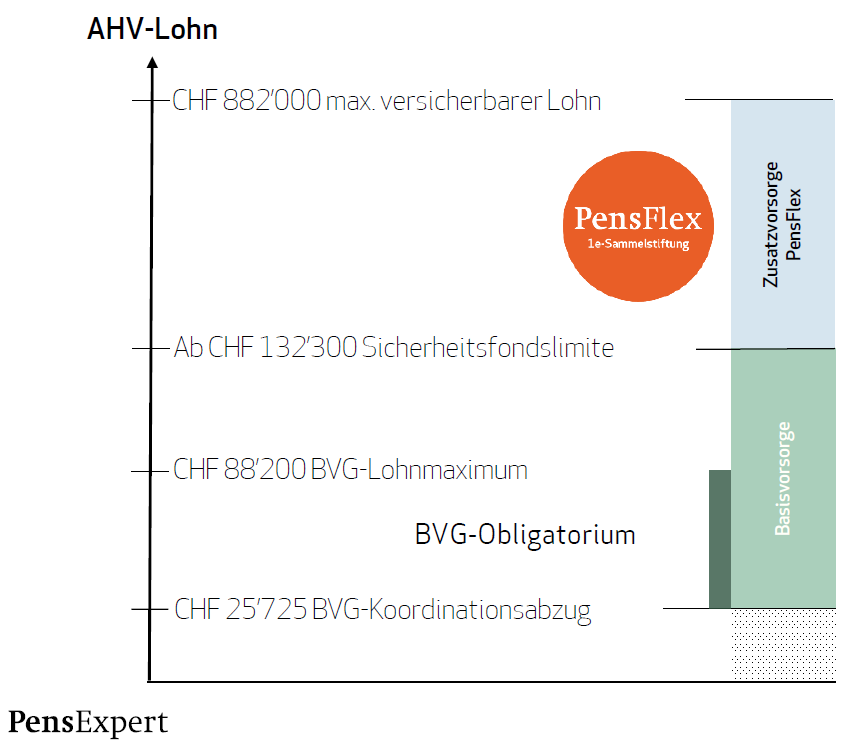

A 1e pension plan allows you to invest your pension assets on insured salary components in excess of CHF 132,300 according to an investment strategy of your choice. You can thus tailor the investments to your personal investment horizon and risk capacity and optimise the return on your pension assets in the long term. The PensFlex pension solution insures individuals as part of a collective foundation or association solution.

This applies to insured salary components from CHF 132,300:

PensUnit collective foundation

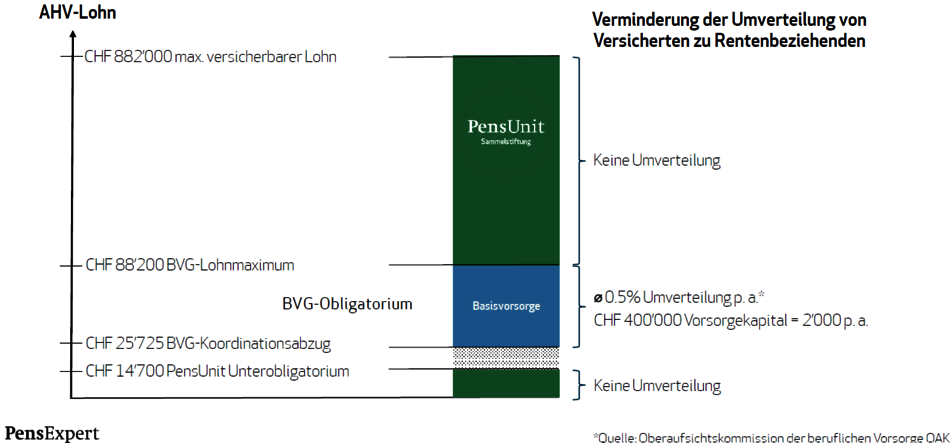

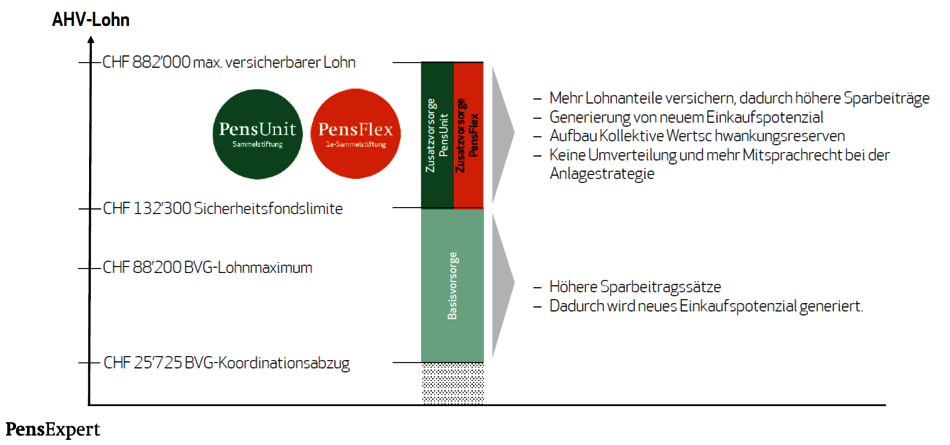

While a PensFlex pension plan can insure a single person under a collective foundation or association solution, the PensUnit pension plan requires several employees to be insured under the same plan. This reduces individuality, but has other advantages. The PensUnit plans can be offered from a salary of CHF 88,200. In addition, the purchase potential is higher, as a compounding factor can be taken into account when calculating the purchase gap.

Another advantage is that with both the PensFlex supplementary pension plan and the PensUnit solution, there is no longer any redistribution between the insured persons. As the two pension plans can be set up using different salary minima, a combination of both plans can be interesting.

Although the PensUnit plan can be less customised, it has the advantage of greater purchasing potential. The opposite is true for the PensFlex solution. It allows more individuality in the investments, but has the smaller purchase potential due to the lack of a compounding factor.

Individual pension fund solutions can have advantages for both the employer and the employee:

- Incentive to attract specialists and managers

- No redistribution in the area of non-mandatory pension provision

- Increased purchase potential - important for pension optimisation, succession planning and dividend planning

- Savings contributions can be maximised

These explanations will be explained in more detail using a practical example:

Initial situation

- Legal form: public limited company with five employees

- Salary structure (AHV salary): Between CHF 150,000 and CHF 250,000

Actual situation

The public limited company has a single pension plan for its employees. This does not allow for individuality and the savings contributions are rather low. At the same time, the public limited company has cash reserves that are not required for operations, which would make the public limited company expensive in the event of a later sale or internal succession plan (so-called heavy public limited company).

By implementing a PensUnit or a PensFlex solution, more salary components can be insured. This also increases the savings contributions. This in turn means that some of the liquid assets that are not required for operations can be transferred to the pension fund. An individual investment strategy can also be implemented and the redistribution effect is eliminated.

For which target groups are these pension plans suitable and what are the requirements?

- Ideal for SMEs, legal entities (AG/GmbH)

- Self-employed persons - provided they have at least one employee insured in the plan

- Companies that want to offer their employees an attractive pension plan

- Entrepreneurs who want to maximise the potential of their pension provision

- Entrepreneurs who wish to act independently (investment strategy, redistribution, etc.)

- Entrepreneurs who want to sell their company (succession planning)

- "Secure" financial basis and long-term horizon

We would be happy to advise and support you in finding the best possible pension solution for you.

Image sources: Cover picture: GETTY IMAGES x UNSPLASH; Pictures in the text: PensExpert