What to make of bonds at the moment?

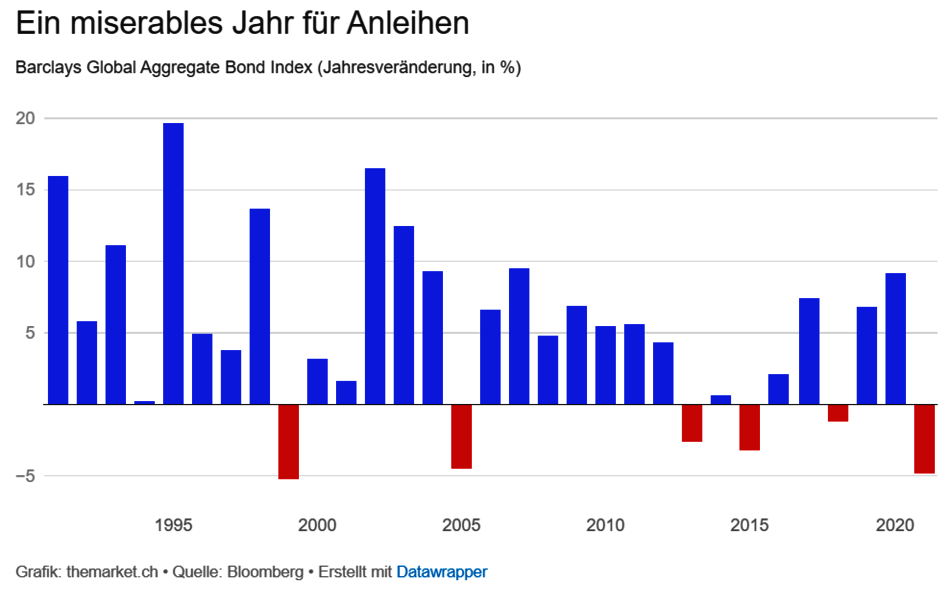

The constellation of geopolitical turmoil (war), rising commodity prices and rising inflation worldwide caused interest rates to rise sharply, putting pressure on fixed-income prices.

This share price shock must of course be put into perspective. Good-quality bonds are repaid at 100% at maturity. The price losses are therefore only temporary, at least in part.

Negative interest rates have made it difficult for years to achieve any return at all with bonds. Now, inflation is also gnawing away at the nominal value. And if interest rates rise in response to inflation, bonds can lose value, as we have seen. So in phases of inflation, bonds are bad in more ways than one. In other market phases, they provide portfolio safety. During inflation, only one thing is certain: with bonds, your purchasing power will shrink.

Of course, bonds remain part of an investment universe. To help you make purchase decisions with confidence, let's first look at the risks of bonds.

The default risk (credit risk)

Bonds are debts. It is not only important that they pay interest. It is also essential that they pay back the amount invested. Here, it is important to find the right balance between yield and the quality of the debtors. The quality of debtors is indicated in the form of ratings: AAA (highest quality) to D (insolvent).

The interest rate risk (market risk)

For the vast majority of bonds, the interest rate is fixed at the time of issue. If interest rates subsequently rise, the bond loses value (at least temporarily until maturity). Conversely, its value increases if interest rates fall.

Inflation risk (inflation)

In addition to the interest rate, inflation must also be taken into account. With a coupon of 1.5% and inflation of 2.5%, the bondholder loses 1% in purchasing power, i.e. the real return is negative.

Bonds - do I still need them?

One thing is clear: In the long run, over decades, stocks are superior to bonds. But bonds stabilize a portfolio against short-term fluctuations in value.

In inflationary times, however, bonds can only play this role, which they fulfill for the portfolio in normal market phases, to a limited extent. This allows only one conclusion: The proportion of bonds in the asset allocation should be kept neutral at most for the time being.

For the sake of better diversification, however, you should not completely avoid debt instruments. When selecting bonds, it is important to consider not only their quality but also their maturity. In the current environment, this should not be too long (3 - 5 years).

If the forecasts of weakening inflation and an inverse yield curve (falling interest rates at the long end) actually come true, bonds would become even more attractive again. This would have a positive impact on real yields as well as on bond prices.

The bond menu

There is a wide range of different bonds on the market. Here is a small selection:

Medium-term bonds

The issuers are mostly banks. These bonds are not listed and therefore the tradability is limited. Different maturities (1-10 years) are available.

Inflation Protected Bonds / Floating Rate Bonds (FRN)

Here the coupon is not fixed for the entire term, but adjusts annually to the interest rate development (or inflation). The interest rate is slightly lower than for ordinary bonds.

Emerging Market Bonds

Bonds issued in emerging markets (e.g. Greece, Brazil, China) pay significantly higher interest rates and therefore carry a higher risk of default.

Junk Bonds

The lowest quality debtor in the "BB" down range. Very high interest rates - very high default risk. Only suitable for experienced investors.

Green Bonds

Bonds where the debtor must use the funds for a sustainable, ecological purpose. Somewhat lower yielding bonds. Strong trend.

Cat Bonds

Catastrophe bonds are contingent on the occurrence of certain catastrophic events (hurricanes, earthquakes, tsunamis, etc.). Issuers are usually insurers or reinsurers.

Convertible bonds (convertibles)

The hybrid form of bonds. These bonds, usually with a small interest rate, give the buyer the right to convert the bond into shares (usually of the debtor) during a certain period, at a predetermined ratio.

Finally, a few investment ideas in Swiss Francs:

CH0511961390 CHF 1.5% Otto 2019 - 2024

CH0508785745 CHF 1.5% Temenos 2019 - 2025

CH1191714703 CHF 1.125% Givaudan 2022 - 2026

CH1211713222 CHF 1.5% Roche Capital Market 2022 - 2026

CH1210198144 CHF 2.717% Clariant 2022 - 2027

CH1214797206 CHF 2.377% Adecco 2022 - 2027

We advise individuals and legal entities on all legal matters around wealth management and are a pioneer in impact investing, which is part of our entrepreneurial identity.

Our focus is on

✓ effort based charging

✓ impact investments

✓ avoiding conflicts of interests

✓ comprehensive overview of your total assets